Airbnb and other short-term letting websites have been a hot topic of debate for some time. In New South Wales, it seems the state government is on the verge of announcing a new short-term letting policy. Our research suggests about a quarter of Airbnb properties in the city are essentially commercial short-term letting operations.

But as cities like Berlin and Barcelona have learned, regulating these platforms is not always easy. Enforcing restrictions against individual hosts can be costly. Airbnb has also challenged regulations limiting short-term letting.

At the same time, there has been a lot of hype about platforms like Airbnb as leaders of a new “sharing economy”. This has made some governments wary of interfering with a potentially lucrative economic driver.

How do you tell if it’s sharing or business?

To ensure these new platforms are regulated effectively, it’s important that we understand exactly what they do, and the impacts they’ve having. Despite Airbnb’s efforts to promote itself as being all about sharing, there’s actually a mix of activities happening on its platform. In a new research paper, we examined these different activities, to better identify how Airbnb is being used and whether the platform should be viewed as a “sharing economy” superstar.

Overall, we found that in late 2016, about a quarter of Sydney’s Airbnb listings were best viewed as short-term letting businesses, rather than examples of the sharing economy in action. The figure was greater for other global cities we looked at – 26% in New York, 28% in London and Hong Kong, and a hefty 49% in Paris.

So how did we reach this conclusion? To start, we needed a definition of the “sharing economy”. We took this to mean economic activity involving the sharing of excess capacity in an asset or service, which is driven by a sharing attitude.

We then took a close look at listing data from the five cities and identified two categories of use:

- House sharing, which includes advertising part of a house (a private or shared room) or a whole house for a small portion of the year (up to 90 days). These uses suggest that the property is otherwise meeting someone’s permanent housing needs.

- Traditional short-term lets, meaning properties permanently offered for short-term rental, thus preventing their use as long-term housing. This includes properties available or booked for more than 90 days per year, and those where the host has multiple listings.

By categorising listings this way, we get a clearer sense of whether Airbnb is really being used to share spare housing capacity, or to run commercial rental accommodation.

Unfortunately, Airbnb keeps tight control over data about the use of its platform. This makes it challenging to quantify these uses.

To get around this, a few organisations have scraped and collated data from Airbnb’s website. While much existing research uses a dataset from Inside Airbnb, our research complements this work by using a dataset produced by the company AirDNA. While neither dataset is perfect, together they provide an increasingly clear picture of Airbnb’s impact.

What did our research find?

Our findings show a significant share of Airbnb hosts are using the platform to engage in economic activity that existed long before Airbnb did – that is, dwellings are used as serviced apartments, B&Bs or holiday rentals. This is commercial activity, not sharing. These properties aren’t just “excess” unused housing space and there’s no “sharing attitude” involved.

While commercial properties are not the majority of listings, other research suggests that this activity nonetheless generates a larger proportion of Airbnb’s income than home-share activity. In many cities this activity is also already subject to planning laws and land-use regulations about “tourist accommodation”. This means these Airbnb listings are potentially in breach of existing laws.

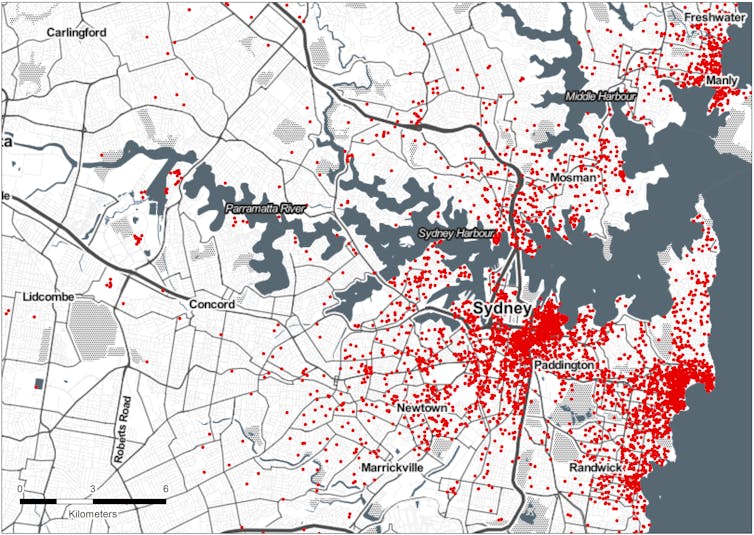

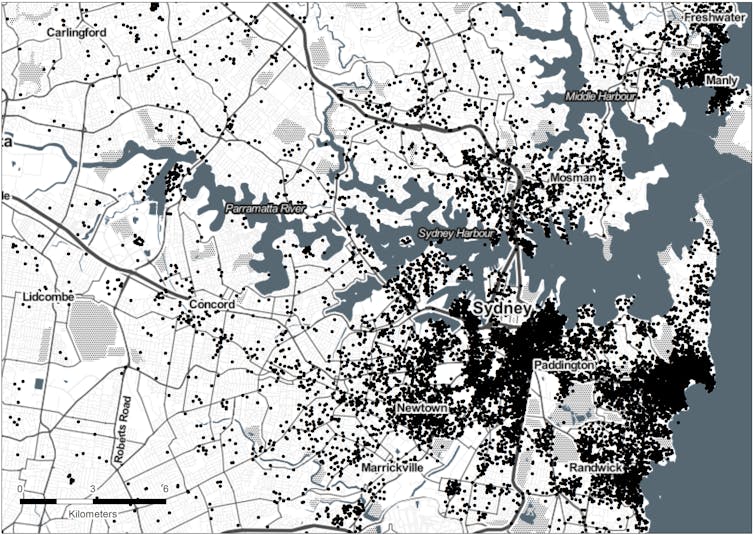

Furthermore, by mapping the Sydney listings we can see that while these traditional short-term lets were only about a quarter of listings, they were overwhelmingly concentrated in suburbs with very tight rental markets.

LOCATION OF TRADITIONAL SHORT-TERM LETTING

LOCATION OF HOUSE SHARING

Another factor is the rapid growth of Airbnb since late 2016. Australia now has 87% more listings than in late 2016. That’s a lot of properties in popular neighbourhoods that might otherwise be long-term rentals. So not only is this commercial activity not “sharing” at all, it’s also potentially pushing renters into shared living elsewhere, by reducing the amount of available rentals.

What does this mean for regulation?

So where does this leave our regulators? In our view, any policy decision needs to account for the different uses of these platforms, and be particularly focused on the impact of commercial short-term letting. While house sharing also raises concerns – particularly in apartment complexes – it at least fits the “sharing economy” model and arguably provides some of the shared financial, social and environmental benefits sharing economy supporters claim.

At the same time, regulators need to act on the lack of transparency in debates about platforms like Airbnb. Without good data, it will be tough for regulators to target their efforts at the most problematic aspects of new technologies. As we conclude in our research paper:

If Airbnb is genuinely committed to the ideal of ‘sharing’, as it regularly claims, it should share its data with regulators, even if it is not made publicly available. Airbnb’s unwillingness to do so (to date) indicates its sharing rhetoric is more of a sales pitch than a guiding philosophy.