As the short-term rental industry has grown with burgeoning tourism in The Woodlands, so has opposition to it.

Despite the The Woodlands’s 14 full-service hotels providing 2,253 rooms, officials face an uphill battle restricting Airbnb’s growth in the township and face complaints from residents about noise and uncollected hotel taxes that could benefit the township.

“This is a community of close-knit people and the folks know each other,” said Hennie van Rensburg, the township’s covenant administrator. “Folks want to keep safe, and the perception is that Airbnbs are not the safest environment for folks to live in.”

Facing varying types of complaints from residents, the The Woodlands Township Development Standards Committee implemented restrictions on the short-term rental service in a 2015 update to its Residential Development Standards, classifying rentals less than 30 days as home businesses.

As part of the restrictions, residents of The Woodlands are required to fill out a small business application and submit it to the township for review — almost all of the application pertains to short-term rentals.

“It would be most difficult to not think that everyone knows about the deed restrictions,” van Rensburg said.

Since the Committee introduced short-term rental restrictions in a 2016 addendum, Property Compliance Manager Neslihan Tesno said, six people have applied and all of them have had their applications rejected.

Rising problems

The increased presence of Airbnb in The Woodlands has closely matched the growing perception of the township as a destination in and of itself.

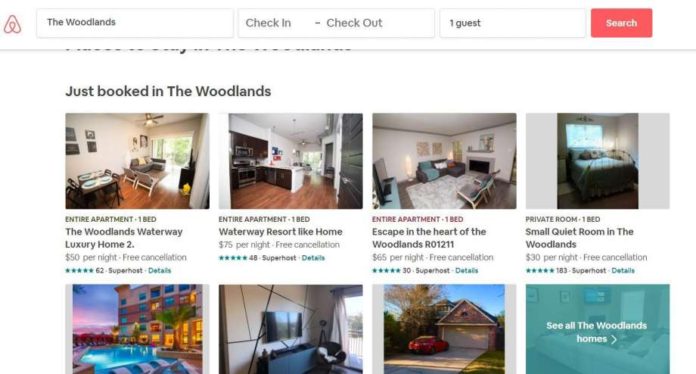

As of press time, there are more than 120 rental properties in The Woodlands listed on the Airbnb website, ranging in prices from $19 a night for a bedroom to more than $115 a night for entire homes or condominiums.

Tourists are an important element of The Woodlands revenue base, and tourists often come to the township for one of the seven major events held in the township on an annual basis— including the Ironman Texas, Wine & Food Week and the Woodlands Waterway Art Festival.

In all, the various events contributed to the more than $8.7 million in revenue brought in by the township in hotel occupancy tax (HOT) revenue in 2017.

“There’s enough rooms to facilitate those events,” van Rensburg said of existing hotels.

Texas law mandates that the HOT tax only be used to promote projects, tourism, advertising, hiring of staff to aid with those events, or events that directly result in more visitors and room nights for the state, therefore generating more HOT taxes.

The Woodlands, like most municipalities in Texas, levies a HOT tax that is paid by guests in accommodations that cost more than $15 a night.

The price threshold would apply to Airbnbs — if they were allowed in The Woodlands.

The 9 percent municipal room tax is projected to generate $8.4 million in 2018, according to recent township budget statistics, with $4.3 million collected so far this year.

The revenue that is brought in is split between the Woodlands Township debt service, the Convention and Visitors Bureau and the mandatory 6 percent paid to the state.

The HOT tax, like in most cities and states around the country, is the main source of funding for Visit the Woodlands, which received 2 percent of the collected HOT taxes from hotel properties in the township.

Issue not as controversial in smaller cities

For the smaller cities in the greater Woodlands area, short-term rentals haven’t caused conflict on a municipal level.

In Oak Ridge North, the 15 percent HOT tax was introduced to accommodate the now-defunct Crowne Plaza project that was set to be built on Interstate 45 and Robinson Road.

Alhough the city currently has no hotels and homeowners within city limits are prohibited from renting their homes for less than 30 days at a time, the tax stands in case of any future accomodation developments.

“The hotel owners, operators or managers would be the one collecting the tax and then reporting the tax to the state and then to the local level,” said Heather Neeley, Oak Ridge North’s director of economic development, in an email interview.

Shenandoah levies a 7 percent hotel tax on its more than 1,000 hotel rooms, and is set to address the issue at the July 11 city council meeting.

The Shenandoah City Council has scheduled an agenda iteam to discuss short term rentals such as Airbnb during a 7 p.m. council meeting on Wednesday, July 11.

The issue first arose at a March 28 council meeting when several residents used public comment to criticize short term rentals, with one unidenfied man telling the council he felt having new customers come and go at homes in his neighborhood wasn’t optimal.