Over graduation weekend, Fry’s Spring resident Chris Meyer rented his house for a “ridiculous amount of money to someone from California,” he said at City Council May 20.

He appeared before council to complain about the difficulty he encountered in getting the proper city permits and in trying to remit the transient occupancy tax, and asked councilors: Why not do what Alexandria and Blacksburg do and have Airbnb collect the lodging tax? He also suggested raising the rate from 7 percent to 15 or 20 percent, and using that money for affordable housing rental vouchers.

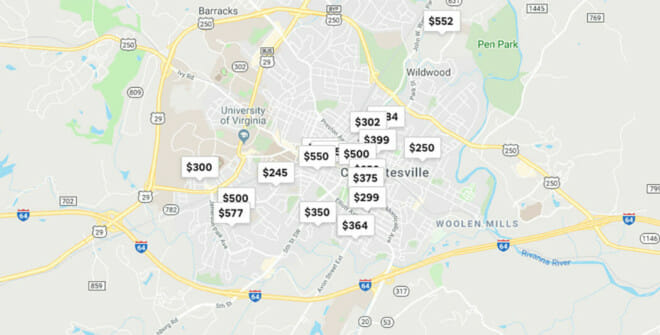

Mayor Nikuyah Walker commended his “very different perspective,” and councilor Kathy Galvin noted that in 2018, the city lost about 250 housing units to short-term rentals.

Commissioner of Revenue Todd Divers is not enthusiastic about the idea of turning lodging tax collection over to a “multinational corporate entity that has repeatedly shown its willingness to flout tax, zoning, and regulatory structures all over the world.”

In a memo to City Council and City Manager Tarron Richardson, Divers says his office is doing a “fantastic” job of collecting transient occupancy tax of licensed homestays—over $1 million since the city created a hotel residential permit a few years ago.

His problem with having Airbnb collect the lodging tax is that the company will not disclose the identity and location of hosts, nor will it allow the city to audit its tax records more than once every four years, which means the city has to take Airbnb’s word it’s collecting all the taxes. Meanwhile, the city still must make sure hosts have business licenses and homestay permits.

Divers also questions how Airbnb can determine the appropriate jurisdiction for an Albemarle rental with a Charlottesville address.

“We’ve done this all over the world,” says Airbnb spokesperson Liz DeBold Fusco. Airbnb has collected more than $1 billion in taxes in 400 municipalities. “I’m not sure why [Divers] thinks our methods don’t work.”

She also “vehemently” disagrees with his characterization the company flouts regulations. “We think that’s baseless.”

Divers points out that 189 jurisdictions in Virginia collect lodging taxes, and he contends that rather than asking why Charlottesville doesn’t follow the Alexandria/Blacksburg model, the question should be, “why did 187 other jurisdictions in Virginia reject it?”

In Meyer’s case, Divers says someone who rents out his home once or twice a year, is “de minimis” by taxation standards, which means the person doesn’t have to get the short-term rental permit. “I’m not going to make you do anything” as far as trying to collect the lodging tax, says Divers, although one is still free to pay the tax if he wants.

However, he’s still checking the Airbnb website, and if someone claims to have an infrequent rental and he finds out otherwise, “I’m going to come to get you,” says Divers.

Meyer met with Divers after the City Council meeting, and learned he didn’t have to do the paperwork, but he still feels the city should be collecting the $125 tax in his case.

And he likes the idea of making a difference between the lodging tax hotels pay and the tax on short-term rentals, upping the transient occupancy tax to 15 or 20 percent on the latter to help mitigate the loss of housing stock.

“That excess revenue should be plowed into rental housing vouchers,” he says, “to help people displaced by Airbnb.”

Developer Oliver Kuttner owns nine apartments on the Downtown Mall that he rents full-time on Airbnb, for which he pays more than $1,000 per month in transient occupancy taxes. He says the city pays “lip service” to affordable housing. In 2015, he wanted to build micro-apartments behind the Glass Building on Second Street SE, but couldn’t get the rezoning needed. An office building is now going up in that spot.

“It cost me $80,000 [in permits] and six months of my life to be denied the permit to build micro-units,” he says. “The city is the single biggest obstacle to lower-cost apartments.”

Now, he wants more decentralized hotels like Airbnb. “We need to support the person who wants to build one hotel,” says Kuttner. “I would like to see more independent hotels than a fifth Marriott downtown.”

Currently Charlottesville has no plans to funnel lodging taxes into affordable housing vouchers, says city spokesperson Brian Wheeler. The taxes go into the general fund, which funds the city’s affordable housing initiatives, he says.

Meyer says he thinks Divers is doing a “very good job” in collecting the lodging tax, but says, “I wonder if we can do better.”